The age group of 3 years and above, 30 healthcare demands, and more than 40 categories of personal well-being

With the change of the epidemic situation in 2023, how has the focus of Chinese consumers on health changed? Do middle-class families still have the desire to consume? What are the characteristics of consumer demand and choice for healthcare products? What are the demand trends for supplements? What are the priorities of R&D in different healthcare categories? What are the significant opportunities in the big healthcare market? Recently, GrowthX, an Illuminera boutique, has officially launched a syndicated report "Win in the Post-COVID Rush - Opportunities in China's Personal Wellbeing Market", which provides a panoramic landscape of big health market after the COVID rush, delving into segmented opportunities, exploring TA differences, and revealing the growth opportunities for the market players.

Scan the QR code in the image for a free report preview

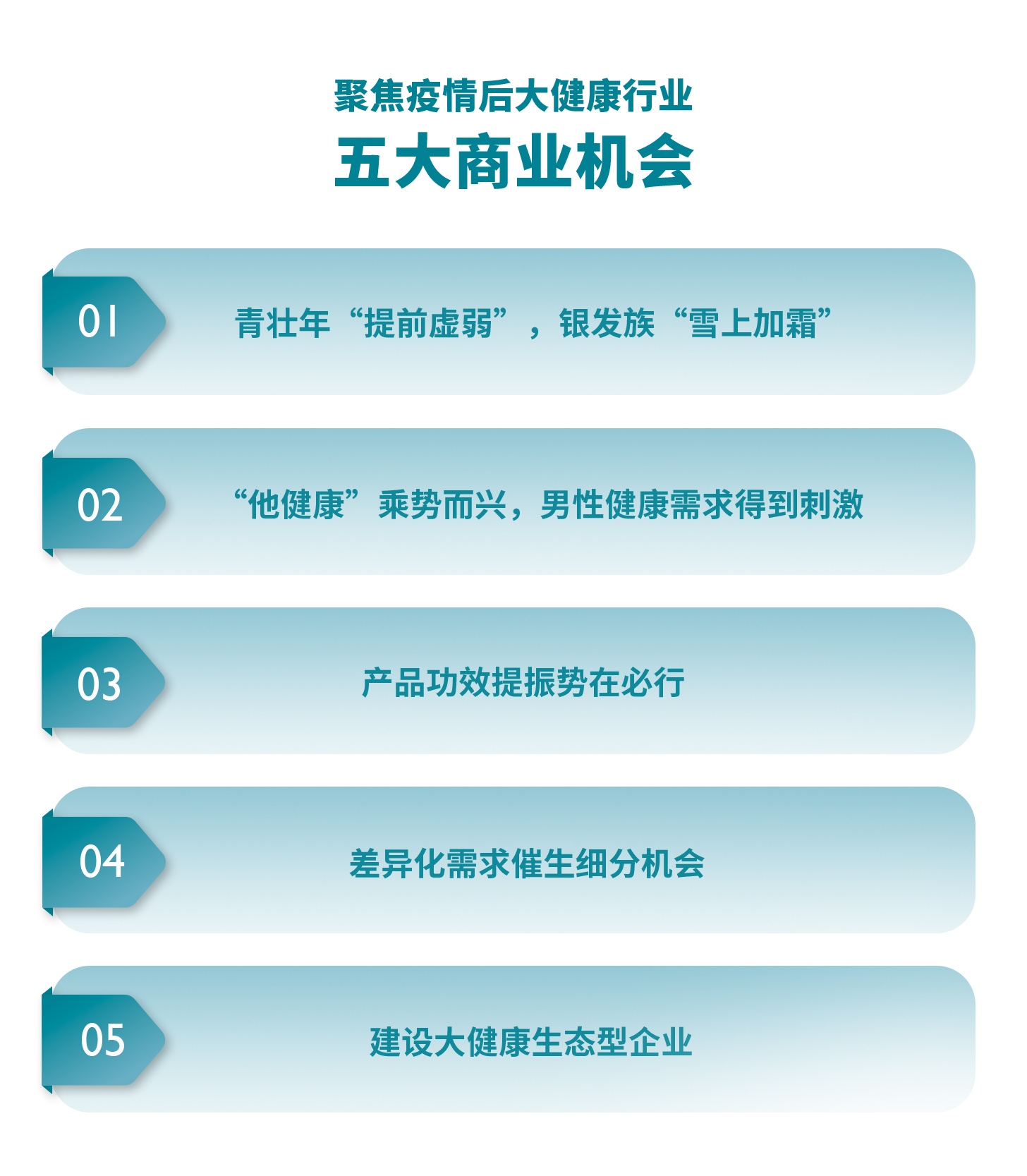

During 3 years of epidemic, when people's health has been affected to varying degrees, the whole society has been paying more attention to medical care and health, and consumers start to attach importance to the health of themselves and their families. Combined the big data on e-commerce consumption with the real behavior data of consumers on mobile terminals provided by Illuminera’s unique insight platform Ghawar, GrowthX was able to reveal the picture of the Chinese consumers’ life in healthcare and identify five major business opportunities in the health consumption after the epidemic.

Opportunity 1: Young adults “get weak ahead of time”, and the elderly “get worse”

GrowthX found that 22% of young adults had experienced a decline in health after recovering from COVID, with an overall "get weak ahead of time" status and a pessimistic expectation toward the future impact; And the silver generation (middle-aged and elderly people over 55 years old) got even worse, with 30% worrying about the uncertainty of future epidemic. Based on this, The Report summarized potential categories for young adults and upgrading directions for the elderly categories.

Opportunity 2: The rise and increasing demand for male health

The Report found that as a group with relatively poor health awareness in daily life, the male population deeply felt the health threat during this epidemic. Therefore, niche health needs related to male consumers were stimulated after the epidemic, such as liver health and heart health. In addition, due to the differences in health needs between men and women, brands need to pay attention to territory selection and marketing designs.

Previously, consumers tended to buy products out of precaution, but after the epidemic, more consumers are buying products to solve real health problems. The Report mentioned that about 50% of category consumers were placing more emphasis on product efficacy. Therefore, which categories are especially in need of efficacy enhancement? Which product feature is most easily accepted by consumers?

Opportunity 3: Product efficacy enhancement is inevitable

Previously, consumers tended to buy products out of precaution. After the epidemic, more consumers are buying products to solve real health problems. The Report mentions that about 50% of category consumers are placing more emphasis on product efficacy. Therefore, which categories are especially in need of efficacy enhancement? Which product feature is most easily accepted by consumers?

Opportunity 4: Differentiated demands lead to segmented opportunities

Different TA groups have different health needs. Certain new consumer brands have profited from segmented opportunities. For example, the chic “digital nomads” born after 2000 are concerned about beauty or vision health; Workplace newcomers with stress have clear needs for gastrointestinal health and mental health; The post-90s who are good at self-adjustment is more focused on the improvement of immunity and energy. Therefore, for big brands, which categories can continue to be segmented in future product line planning? In addition to gender-specific versions, what are other different ways to segment?

Opportunity 5: Building an enterprise with an ecosystem of big health and personal well-being

Currently, there are two major trends in the market: consumers' expectations of the strong efficacy of supplements and the "consumerization" of OTC/medical device products. Under the influence of these two trends, enterprises in the big health and personal well-being area should rethink product portfolio and market expansion, explore more opportunities by creating competitive products and fully utilizing digital transformation. The Report would also provide professional advice to "future ecological enterprises" on territory selection and channel design.

The Report comprehensively scanned 30 categories of healthcare demands and more than 40 categories of personal well-being products based on over 3,000 respondents aged 3 years and above, in T1-T4 cities. Focusing on dimensions of income & consumption level, health impact, key territories, lower-tier markets, the silver generation and children, OTC, and medical devices, the Report also provided solutions and strategic directions for the following business issues.

• Which segment of the population has become less confident in spending? Will the consumption level of the middle class pick up again?

• Which health areas have the potential to grow after the pandemic?

• In terms of lower-tier market, what are their healthcare demands and marketing approaches?

• What is the living situation of the silver generation? What are the opportunities for elderly-specific milk powder?

• How have people's drug-buying decisions changed after the pandemic? Which is more important, brand or ingredient?

• Will medicine stockpiling desire continue since the pandemic? What kinds of OTC products are more likely to be chosen by families?

• Is fertility desire severely suppressed? Will the newborn population fall off a cliff?

In addition to the Report, Illuminera will continue to help brands track the impact of the post-epidemic era, design business plans, explore potential markets, identify new product opportunities, anchor key target groups, and win at the new starting point in the blue ocean market of healthcare consumption.

For more relevant information, please send an email to marketing@illuminera.com.