The consumerization of healthcare reflects the growing involvement and influence of patients in treatment decisions, especially for diseases related to personal privacy, cyclical and difficult-to-cure diseases, or some chronic diseases such as diabetes. At a time when leading pharmaceutical companies are focusing more and more on breaking through the out-of-hospital retail channel, we have selected the GLP-1 category, closest to consumers among diabetes medicines, to analyze the source of online awareness and the influence of related content.

In 2022, Tesla founder Elon Musk's twitter post brought Semaglutide to public and rapidly made it a global buzz. In the meantime, the approval of the first domestic liraglutide for the treatment of obese or overweight patients in July this year, resulted in an even more active and crowded GLP-1 market. However, who are their target consumers? How to describe the TA portrait? Where do they get product-related information? What content can generate impetus for them?

Assisted by the tracking and measuring capability of Iluminera’s big data platform Ghawar, we found several interesting data sets, which provide insights into the user scale and potential profiles of GLP-1 products.

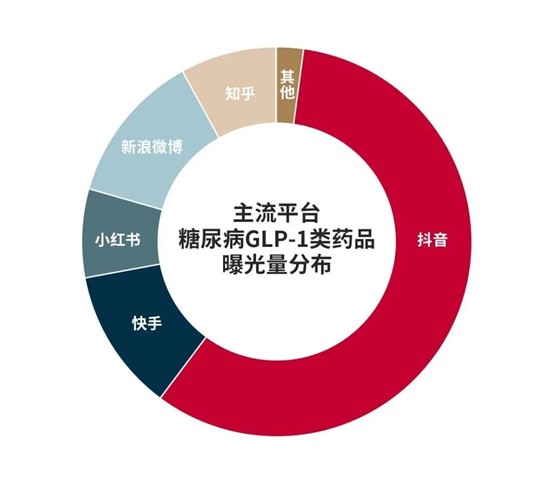

Ghawar data shows that Semaglutide had the highest online exposure across the entire digital marketing channels, 6 times more than that of the second-place liraglutide. In terms of platforms, Tik Tok (China’s Douyin) is the core channel for peptide products to communicate with consumers, with exposure generated from it accounting for more than 50% of the total exposure on mainstream platforms. In addition to Douyin, kuaishou, Sina Weibo, Zhihu and Red are also the important exposure channels for peptide product related content.

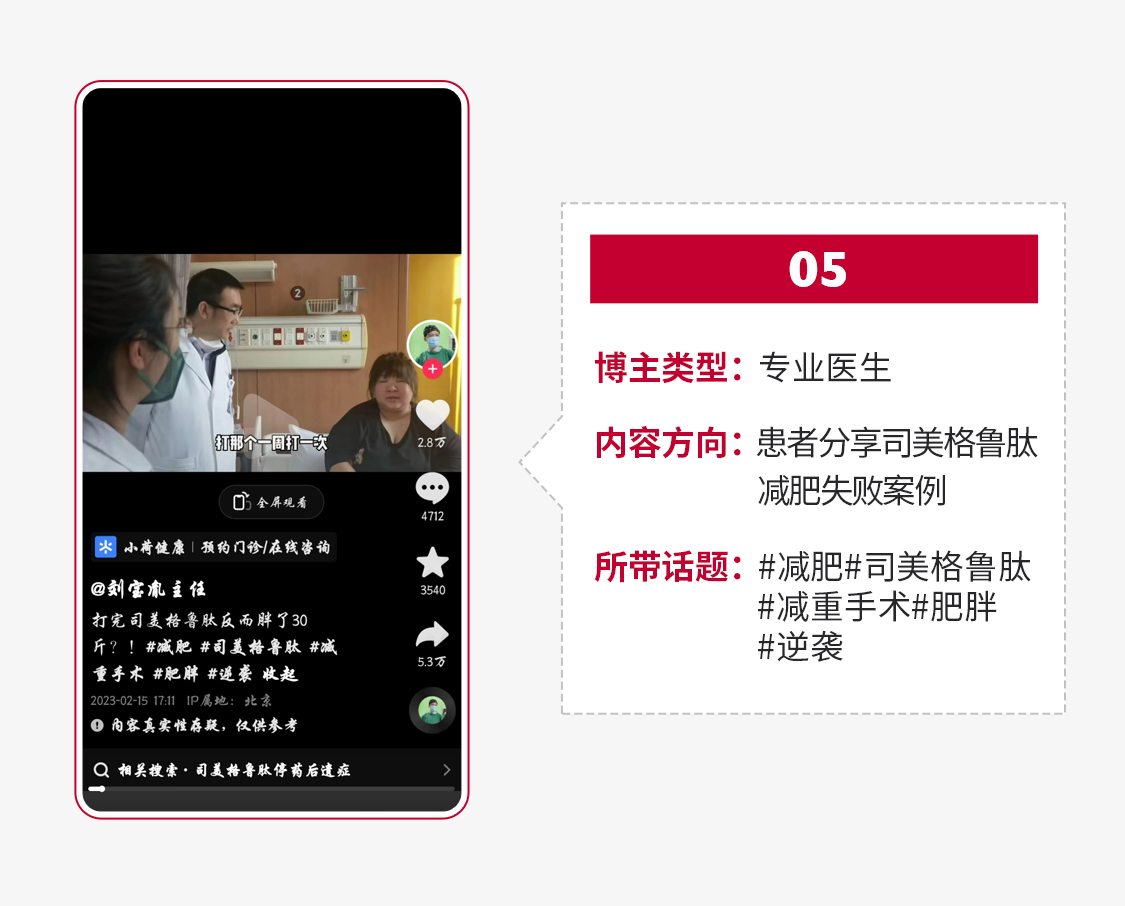

In addition to exposure, whether content content in social media is good enough relies on also in its ability to drive further interest of the exposed consumers. In other words, after being exposed to social media content, do they actively search, browse, bookmark, and purchase related products? When it comes to peptide products, Ghawar® has identified 5 types of content which can potentially drive awareness and intention. All of them had the highest exposure and were broadcast on the Douyin platform.

Among them, the most exposed and popular content #01 was broadcasted 2.1 million times with Elon Musk's celebrity "element", while the content with the highest driving force was #02, which was mainly shared by professional pharmacists.

Ghawar® also shows that, across content types, news stories and patient sharing are hardly effective in driving intentional behaviors - Musk's presence did bring high exposure, but the content alone is not a strong driver. Users still need to be educated with other content. Meanwhile, the sharing of medication by real "patients" cannot rely solely on authenticity to influence others, and the driving force of both types are lower than the benchmark value (50).

The HCP education content has a driving force index of 104, which is much higher than patient sharing and news reporting. High-quality HCP content is still the preferred choice to raise consumers' awareness of medication and drive them to further understand and even to make the purchase. To achieve high propulsion, in addition to the persona establishment, building word-of-mouth and trust, it is also necessary to focus on topic's fit with reality, the freshness and the vividness of the description, as well as to pay attention to the comment section. For example, in the five examples above, the leading comment of #02 image acted as a positive supporter, assisting to boost the post-exposure effect.

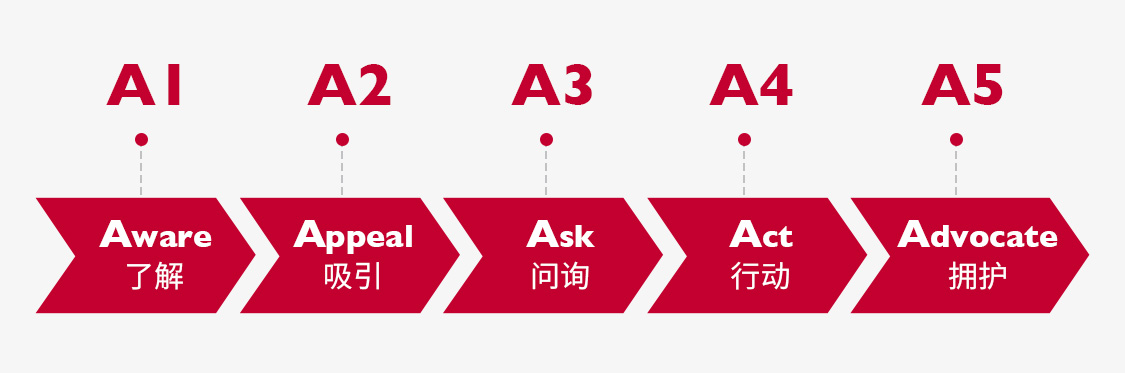

On this basis, when devising the content of patient education, pharmaceutical enterprises should clearly plan the objective of different contents from the perspective of the 5A pathways: is it for awareness building in A1, or for seeding the intention in A1-A3, or for improvement of DOT in A5? In addition to using KOL to generate more acquirement in A3, it is also necessary to think about the importance of the former A1 and the latter A4 &A5, and make relevant strategic layouts in advance according to the business needs.

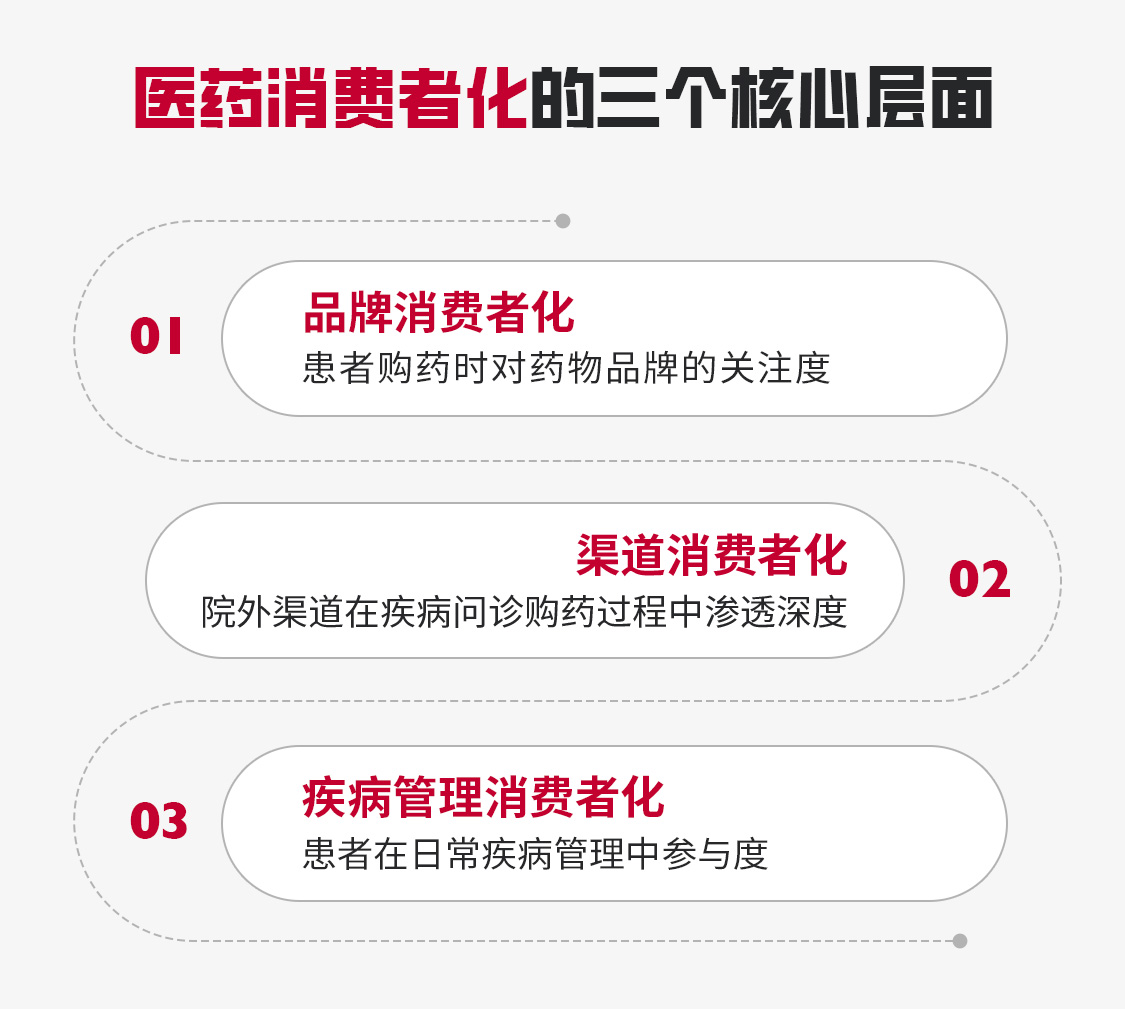

Consumerization is becoming a key direction for many pharmaceutical companies to ride on tides, and some companies have already taken awareness building in retail channels as one of their core tasks. Devising roadmap of pharmaceutical consumerization through three dimensions of brand, channel and disease management is particularly important for building the competitive advantages in digitalization.

Based on the self-developed big data platform Ghawar, Illuminera has helped many brands in the pharmaceutical industry to gain in-depth insights into the sources of consumers' category or brand awareness as well as their behavioral preferences in the mobile end, to explore the content preferences and efficient communication methods of their target consumers, and to build media strategy and consumer mind tracking.

For more about in-depth industry observations on healthcare or pharmaceutical consumerization, please contact us.

For more relevant information, please send an email to marketing@illuminera.com.